Table of Content

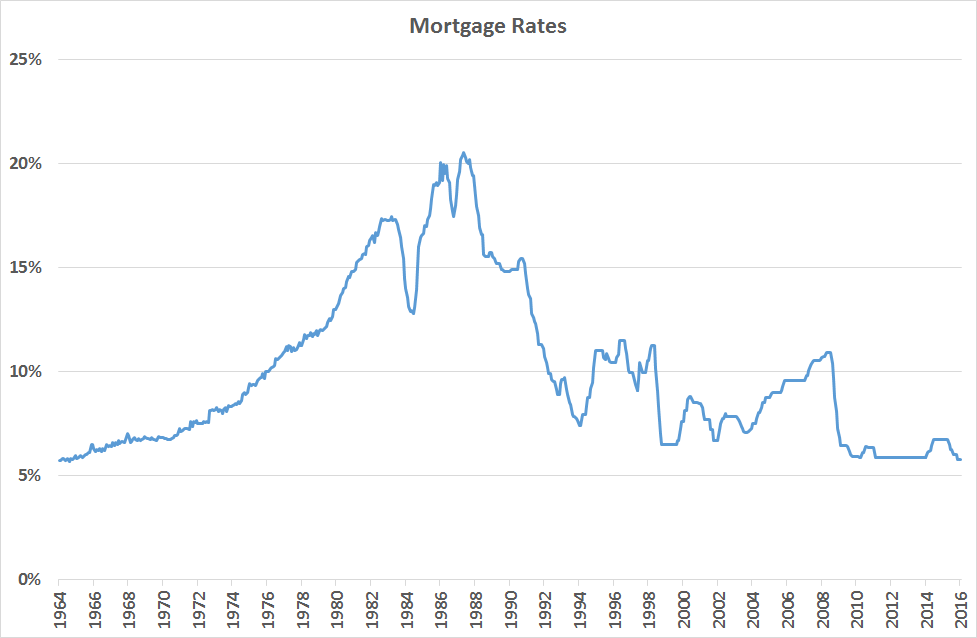

A credit score above 720 will open more doors for low-interest-rate loans, though some loan programs such as USDA, FHA, and VA loans can be available to sub-600 borrowers. Although, if the Fed gets inflation in check or the U.S. enters a meaningful recession, mortgage rates could come back down somewhat. Thanks to sharp inflation growth, higher benchmark rates, and a drawback on mortgage stimulus by the Fed, mortgage rates spiked in 2022. The Fed is likely to keep hiking interest rates, which could lead to further mortgage rate increases. On the other hand, if the Fed’s actions lead to a recession, that could actually tug mortgage interest rates down. So it’s nearly impossible to predict what will happen to mortgage rates in late 2022 and 2023.

A 20-Year Fixed VA loan of $300,000 at 5.63% APR with a $75,000 down payment will have a monthly payment of $2,084. A 20-Year Fixed Jumbo loan of $647,201 at 6.18% APR with a $161,800 down payment will have a monthly payment of $4,705. A 20-Year Fixed FHA loan of $0 at 0% APR with a $0 down payment will have a monthly payment of $0.

Home Loan Resources

Pleaseclick hereto provide your comments to Bankrate Quality Control. If you are seeking a loan for more than $548,250, lenders in certain locations may be able to provide terms that are different from those shown in the table above. You should confirm your terms with the lender for your requested loan amount. Advertisers may have different loan terms on their own website from those advertised through Bankrate.com.

Lenders nationwide provide weekday mortgage rates to our comprehensive national survey to bring you the most current rates available. Here you can see the latest marketplace average rates for a wide variety of refinance loans. The interest rate table below is updated daily to give you the most current refinance rates when choosing a home loan.

Is a 20-Year Mortgage a Good Option for Refinancing?

When interest rates are relatively high people are more inclined to opt for adjustable-rate mortgages which have a lower introductory rate. You have an adjustable-rate mortgage nearing the end of its initial term. A 20-year fixed mortgage will give you more stability, since your rate won’t change for the lifetime of the loan. When stacking a 20-year mortgage against a 10- or 15-year mortgage, it will take you longer to pay off the 20-year mortgage, but the monthly payments will be more affordable.

For example, a 30 year fixed loan may be available at 4%, a 20 year at 3.75%, a 15 year at 3.50% and a 10 year at 3.25%. These rates continually fluctuate but they often follow this pattern. If interest rates fall the homeowner can refinance into a lower cost loan. If inflation picks up and broader financial market rates rise, the lender is stuck with the same rate they got when the loan was originated. As with other fixed term loans, the interest rates on this plan will remain constant for the life of the loan.

Comparing different mortgage terms

To figure out how much a difference in interest rates will cost you for your mortgage. If you receive an unexpected windfall, such as a work bonus or an inheritance, you might be able to use the funds to make an additional payment towards the principal. Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. Lower interest rate – Interest rates on 20-year loans are usually lower than on 30-year loans. Jay Govender and Maleshini Reddy from OOBA provided outstanding assistance and guidance in securing our home loan.

Although the Fed’s strategy helped push inflation back to normal levels by the end of 1982, mortgage rates remained mostly in the double-digits for the rest of the decade. At the current average rate, you'll pay $634.70 per month in principal and interest for every $100,000 you borrow. While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

What is a 20-year mortgage?

Visit our fixed-rate loan calculator to estimate your 20-year fixed mortgage monthly payment. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. One mortgage point is equal to about 1% of your total loan amount, so on a $250,000 loan, one point would cost you about $2,500. Click on “Calculate ,” and you’ll receive a monthly principal and interest payment, as well as monthly taxes, insurance, and PMI payments. Click on “Create Amortization Schedule,” and a separate browser window will open with your month-to-month payment plan. Use the following tabs to switch between current local 20 year FRM rates & our calculator which estimates 20 year mortgage loan payments.

Since it's a shorter loan term you will end up paying a full decade less in interest, which adds up to tens of thousands of dollars in savings. Bankrate has been the authority in personal finance since it was founded in 1976 as the “Bank Rate Monitor,” a print publication for the banking industry. Bankrate has been surveying and collecting mortgage rate information from the nation’s largest lenders for more than 30 years. A 20-year fixed-rate mortgage is a home loan that has a repayment period of 20 years.

Homeowners who want to pay off a mortgage faster than the conventional 30 years and save on interest costs should consider a 20-year home loan. With rates at historic lows, it’s a great time to start searching for the best 20-year mortgage rates to help you save tens of thousands of dollars over the entirety of your mortgage term. The costs and fees with a 20-year mortgage are similar to those of mortgages with other repayment terms. Expect to pay an average of about 2 to 4 percent of the loan’s principal amount atclosingin fees, including origination fees and third-party costs like title insurance.

While the monthly payments for a 20-year mortgage are smaller than a 10- or 15-year mortgage, you can expect to pay more for a 30-year mortgage. In turn, it's less affordable as you'll need to pour more cash into paying off your house each month. Take a look at mortgage refinance rates for a number of different loans. If you have good credit and strong personal finances, there’s a good chance you’ll get a lower rate than what you see in the news. With a 15-year mortgage, you’d have a higher monthly payment because of the shorter loan term.

Different mortgage types usually have different rates, so do your research. For instance, adjustable-rate mortgages have lower initial rates but will fluctuate afterward depending on current market conditions. Fixed-rate mortgages may be higher but borrowers don’t need to worry about rates changing throughout the entirety of the loan term.

A 125% loan, often used in mortgage refinancing, allows homeowners to borrow more money than the equity they have in their property. A subprime mortgage is normally issued to borrowers with lower credit ratings. It typically carries a higher interest rate that can increase over time. An adjustable-rate mortgage is a home loan with a variable interest rate that’s tied to a specific benchmark.

The 15-year is the next most popular fixed-rate loan, with loans of other durations far less common. Both the 10-year and 20-year combine to have under a 10% share of the market. Refinancing to a 20-year mortgage will cost less interest over the life of the loan than a 30-year mortgage of the same amount. If higher payments are manageable and paying off your loan faster and for less interest are priorities for you, then a 20-year mortgage may make sense for your situation.

No comments:

Post a Comment