Table of Content

To put it another way, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate mortgages. These types of loans are best for those who expect to sell or refinance before the first or second adjustment. Rates could be much higher when the loan first adjusts, and thereafter. Compared to a shorter term, such as 15 years, the 30-year mortgage offers lower, more affordable payments spread over time. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

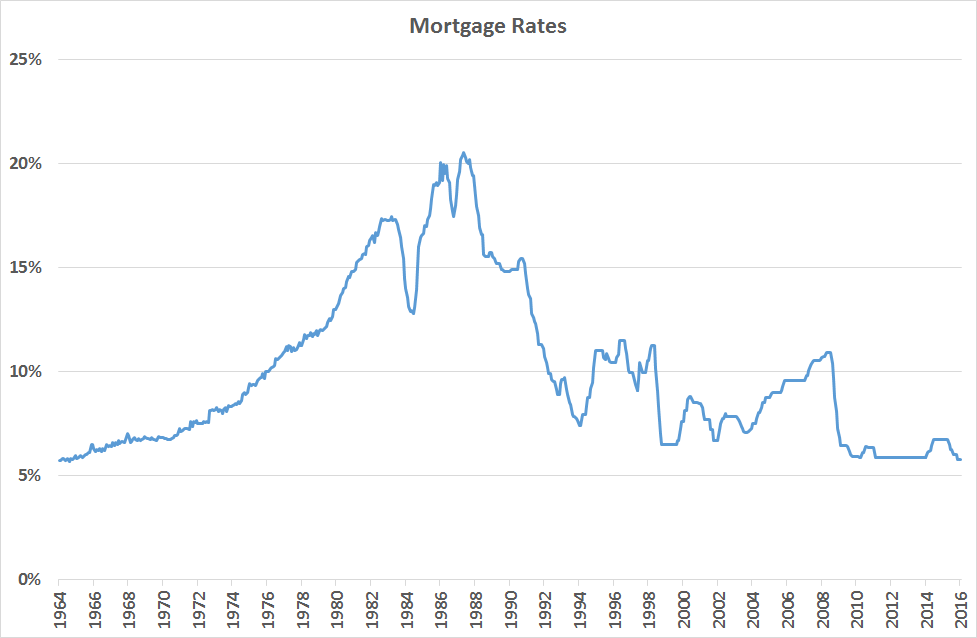

After rising sharply throughout 2022, mortgage rates took their largest dip in 41 years on November 17. That was followed by additional drops over the net two weeks, putting rates at their lowest level since September. Credible can help you compare current rates from multiple mortgage lenders at once in just a few minutes. Use Credible’s online tools to compare rates and get prequalified today. Based on data compiled by Credible, mortgage rates for home purchases are mixed today, with two key rates rising, one falling and another holding steady since yesterday. In March 2022, the Consumer Price Index, an important gauge of consumer inflation, increased by 8.5% — the largest 12-month spike since 1981.

Current Mortgage Rates by State

For example, a 30 year fixed loan may be available at 4%, a 20 year at 3.75%, a 15 year at 3.50% and a 10 year at 3.25%. These rates continually fluctuate but they often follow this pattern. If interest rates fall the homeowner can refinance into a lower cost loan. If inflation picks up and broader financial market rates rise, the lender is stuck with the same rate they got when the loan was originated. As with other fixed term loans, the interest rates on this plan will remain constant for the life of the loan.

For example, during inflationary periods when interest rates jump quickly and may be unpredictable, variable rate loans could create a financial hardship for some borrowers. They may find that the lender increased the mortgage payment because the prime rate jumped. The mortgage payment may continue to rise at the discretion of the financial institution.

Comparing 30-year vs. 15-year fixed rates

Refinancing to a 15-year fixed-rate mortgage will cost less interest over the life of the loan than a 20-year mortgage of the same loan amount. If higher payments are manageable and paying off your loan faster and for less interest are priorities for you, then a 15-year mortgage may make sense for your situation. To get the best rate on a 20-year fixed rate loan, you should shop around for rates, keep track of mortgage rate trends, and talk to multiple lenders. You can compare multiple quotes from lenders on Zillow, anonymously.

While you might be able to get approved for a 20-year mortgage refinance with a low credit score, to get the best interest rate possible, you'll need a strong score. Also, be prepared to provide the lender documents such as tax returns from the last two years, recent pay stubs, bank statements, statements from retirement and other brokerage accounts. Even if the total you'd like to borrow would be the same for a 20-year mortgage, you might have an easier time qualifying for a longer-term loan because of the difference in monthly payments. A rate and term refinance can save you money in the long run, but typically you’ll want the new rate to be at least 0.75% to 1% below your current rate. That said, the recent spike in refinance rates has drastically reduced the number of homeowners with interest rates that are well above today’s average rates. Your credit score directly affects your mortgage rate—those with low credit scores won’t be able to qualify for the best rates out there.

Interested in refinancing? See rates for home refinance

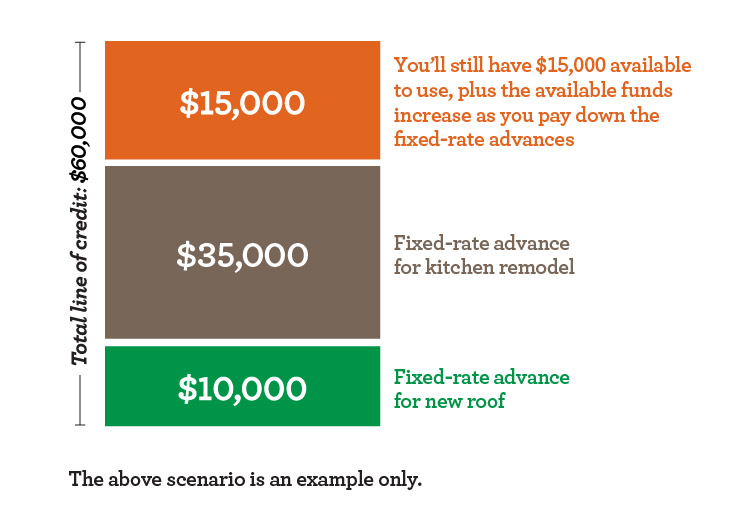

Right now, average 15-year fixed refinance rates are 5.98%, a decrease of 10 basis points from what we saw last week. In this hot housing market, the ability to turn the equity in your home into cash with a home equity line of credit has become increasingly popular. For those wanting to consolidate high-interest debt or make much needed home repairs or upgrades, a HELOC could make sense. If you go that route, you’ll want to understand the repayment schedule, interest rate and fees because they could differ from a traditional mortgage. For the week of Oct. 9, 1981, mortgage rates averaged 18.63%, the highest weekly rate on record, and almost five times the 2019 annual rate. The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence.

The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates have so far risen beyond 7 percent in 2022. Because you have lower payments, you can qualify for a bigger loan and a more expensive house. You can save thousands of dollars over the life of your mortgage by getting multiple offers. Mortgage rates have been on a wild ride as of late, with the 30-year fixed now past the once-unthinkable threshold of 7 percent as the Federal Reserve cracks down on inflation. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Borrowers with a 30-year fixed-rate jumbo mortgage with today’s interest rate of 6.65% will pay $642 per month in principal and interest per $100,000. That means that on a $750,000 loan, the monthly principal and interest payment would be around $4,825, and you’d pay approximately $983,305 in total interest over the life of the loan. The average interest rate on the 30-year fixed-rate jumbo mortgage is 6.65%. The 30-year fixed rate on a jumbo mortgage is currently higher than the 52-week low of 6.58%.

Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. The home is typically the largest purchase most consumers will ever make in their lifetimes. While the 30-year loan is more popular, the 20-year builds equity faster & charges a lower rate of interest which saves even more money. The above table shows how a person choosing the 20-year option can save nearly $90,000 in interest by paying about $260 more per month than they would pay on a 30-year loan. Some buyers who choose a 30-year loan may believe they'll make plenty of extra payments along the way to pay off their home faster, but money sitting around often finds a way to be spent.

This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there. Following a succession of cuts, the South African Reserve Bank has now increased the interest rate. Less interest paid over the life of the loan than a 30-year mortgage.

Of course, all of this depends on how many years you have left on your current mortgage and the amount you want to refinance. That’s why it’s best to shop around to see what makes the most sense for your financial situation. A 20-year mortgage works the same way as 15- and 30-year mortgages, it just has a 20-year term instead.

No comments:

Post a Comment